Clean Energy Transition Continues Despite Reliability, Supply Chain, and Financial Uncertainty

Although there is a risk of energy shortfalls in parts of the U.S. if extreme summer temperatures materialize, there is no stopping the clean energy transition that is sweeping the nation. Energy storage capacity is poised to skyrocket with government backing and equity-intensive financing.

As the Northern Hemisphere moves headlong into the summer peak season, weather is top of mind for most power system managers. The North American Electric Reliability Corp.’s (NERC’s) 2023 Summer Reliability Assessment, released in May, says, “Weather officials are expecting above normal temperatures for much of the United States … In addition, drought conditions continue across much of the western half of North America, resulting in unique challenges to area electricity supplies and potential impacts on demand.” NERC warned, “two-thirds of North America is at risk of energy shortfalls this summer during periods of extreme demand.”

Mark Olson, NERC’s manager of Reliability Assessments, noted that increased, rapid deployment of wind, solar, and batteries has made a positive impact on the system, but he said “generator retirements continue to increase the risks associated with extreme summer temperatures, which factors into potential supply shortages in the western two-thirds of North America if summer temperatures spike.”

“The 2023 Summer Reliability Assessment makes clear that electric grid reliability is increasingly weather dependent as the power system transitions to a greater reliance on wind and solar,” Michelle Bloodworth, president and CEO of America’s Power, a national trade organization that advocates on behalf of the U.S. coal fleet and its supply chain, said in a statement issued to POWER.

The NERC report says, “Unexpected tripping of wind and solar [photovoltaic] resources during grid disturbances continues to be a reliability concern.” Meanwhile, it says, new Environmental Protection Agency (EPA) rules that restrict power plant emissions, including the Good Neighbor Plan, which was finalized on March 15, “will limit the operation of coal-fired generators in 23 states, including Nevada, Utah, and several states in the Gulf Coast, mid-Atlantic, and Midwest.”

“Coal is more than five times as dependable as wind and more than twice as dependable as solar when electricity demand is greatest, yet bad public policy and EPA regulations are forcing the closures of coal plants. Utilities have already announced plans to retire more than 40% of the remaining U.S. coal fleet by 2030, possibly one reason that NERC President Jim Robb has warned of a disorderly and too quick retirement of older generation,” Bloodworth said.

Supply Chain and Labor Issues Continue

Among other findings in the assessment, NERC warned that supply chain constraints and low inventories could pose summer reliability problems. “Supply chain issues present maintenance and summer preparedness challenges, and are delaying some new resource additions,” the report says. “Difficulties in obtaining sufficient labor, material, and equipment as a result of broad economic factors has affected preseason maintenance of transmission and generation facilities in North America.”

Additionally, low inventories of replacement distribution transformers could slow restoration efforts following hurricanes and severe storms. “The electric industry continues to face a shortage of distribution transformers as a result of production not keeping pace with demand,” the report says.

However, Mike Edmonds, Chief Commercial Officer at S&C Electric Co., said that while supply constraints remain, some areas are improving. He specifically noted that electronics are now easier to source. “We still see some challenges for our customer projects. For example, transformers still have a very long lead time, and can take several years for full delivery, as are castings,” he said.

Jim Thomson, vice chair with Deloitte Consulting LLP and leader of the firm’s U.S. Power, Utilities & Renewables practice, agreed that supply chain constraints have improved with pandemic recovery, but he said problems still continue to affect the industry. “In addition to the significant and ongoing issues impacting solar supply chains, there are still challenges with other materials and components, as well as ongoing labor shortages,” Thomson said.

In addition to transformers being in short supply, Thomson said current shortages of electrical steel are hampering construction of electric vehicle (EV) chargers and other electrical equipment. “Industry groups, including three major power industry trade associations—the Edison Electric Institute (EEI), American Public Power Association (APPA), and National Rural Electric Cooperative Association (NRECA)—have written to the administration requesting that they take action to shore up domestic supplies,” he said.

Meanwhile, on the labor front, Thomson said, “The electric power sector faces a rapidly retiring workforce at the same time that it’s competing for new workers with digital and technical skills such as data management, cloud computing, etc. The power and renewables sectors need growing numbers of wind turbine technicians, solar panel installers, as well as nuclear plant engineers—and they’re being impacted by labor shortages in the construction and manufacturing industries.”

Energy Storage Reaches Prime Time

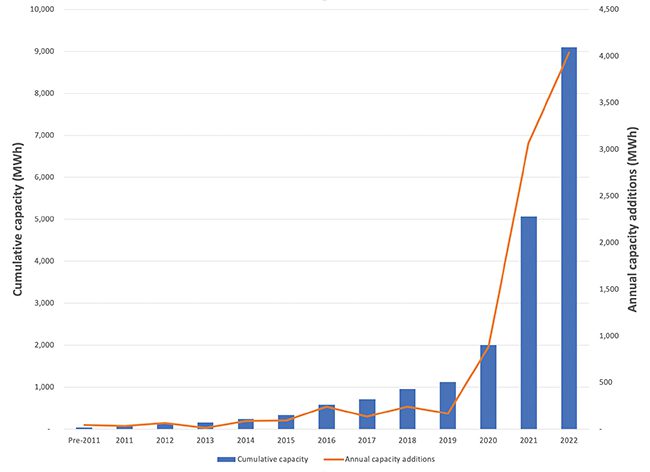

Energy storage witnessed a record year in 2022 (Figure 1), according to the renewable energy advocacy group American Clean Power. More than 4 GW and 12 GWh of energy storage was commissioned, representing an 80% increase in total operational storage capacity. Hybrid project installations such as solar plus storage or wind plus storage were 60% higher in 2022 than in 2021, setting a new record in the hybrid space at nearly 6 GW of installations. The trend is expected to continue.

|

|

1. Energy storage capacity has been growing rapidly in recent years with no end in sight. American Clean Power reported there were 245 storage projects in development, totaling 19,621 MW/53,184 MWh at the end of the first quarter 2023. Source: American Clean Power |

“The intermittent nature of renewable energy generators means that energy storage systems (ESS) will increasingly be necessary as a buffer between when the power is generated and when it is needed. The U.S. will need a variety of battery technologies to support this transition,” Scott Childers, vice president of Stryten Energy’s Essential Power division, told POWER.

However, one of the biggest bottlenecks with energy storage, according to Childers, is the supply chain for lithium. “80% of the global lithium raw material refining is controlled by China. China is also the world’s top vanadium producer,” he said. “In comparison, the U.S. produces less than 2% of the global lithium supply, despite holding 17% of global reserves. And despite significant deposits of the mineral, there are no primary producing vanadium mines in the U.S. This creates long supply chains for the U.S. that are vulnerable to international conflicts.”

A potential solution is to focus on domestic manufacturing to minimize these supply chain disruptions and bolster national security. “The Bipartisan Infrastructure Investment and Jobs Act provides over $3 billion in funding for domestic battery manufacturing and supply chains. The bill also includes $3.1 billion in funding to build more batteries and components in America and shore up domestic supply chains,” said Childers.

A report issued by Troutman Pepper, a U.S.-based law firm with offices in 23 cities, suggests legislation has created both opportunity and complexity. “The Inflation Reduction Act (IRA) has supercharged global interest in U.S. battery storage,” the report says. However, challenges presented by the rapid expansion of battery storage include constraints on battery supplies; labor and expertise shortages; a continued lack of clarity over parts of the IRA; and prohibitively long interconnection queues in some regions. Still, it says, “Energy storage in the U.S. is on the cusp of explosive growth.”

Getting a utility-scale energy storage project off the ground starts at the permitting stage. “While some state and local governments have implemented policies and incentives to move this process along, there is still a ways to go to make permitting pathways seamless on a national level,” Mike Marsch, Chief Development Officer at BlueWave, a clean energy development company, told POWER. “As a new technology, storage is not explicitly contemplated in most zoning and permitting laws, and developers therefore need to work with AHJs [authorities having jurisdiction] to provide education on the projects, amend laws, and/or fit into existing land use definitions.”

Marsch added, “The interconnection process is a bottleneck and requires great collaboration between communities, developers, and utilities to manage through.”

Recently, long lead times for batteries have forced developers to commit to technology vendors earlier in the development process than they would typically like. However, rapid growth in U.S.-based manufacturing could help. Clean Energy Associates (CEA), a clean energy advisory company with offices in Denver, Colorado, and Shanghai, China, reported at the end of May that North America had become the fastest-growing regional market for planned new battery cell manufacturing plants. “China remains the leading manufacturing hub for battery cells, but its share is likely to decline in coming years,” CEA said.

It said much of the growth in the U.S. is attributable to incentives provided by the IRA. Meanwhile, the company said several planned battery cell production facilities in Europe have been delayed or canceled, due in large part to high energy prices and more attractive policy support from other markets.

Banking Sector Volatility Hits Projects

“Increasing interest rates have dramatically changed the project financing model,” S&C Electric’s Edmonds said. “Right now, utilities are weighing whether projects should focus on connecting more generation capacity or on the infrastructure changes that will deliver on customer expectations of more electricity. It’s sometimes easy to go back to transmission as that is federally regulated as opposed to distribution, which is locally regulated.”

Meanwhile, analysis conducted by S&P Global Commodity Insights, suggests raising new debt for capital-intensive energy infrastructure is becoming increasingly difficult as demand for project financing intersects with headwinds in the U.S. banking sector. “Ongoing banking sector volatility and renewed attention from regulators in the wake of the Silicon Valley Bank and First Republic Bank failures have diminished already scant risk appetite,” the analysis says. As a result, energy transition projects—such as hydrogen, offshore wind, and carbon capture—that rely on significant debt financing from traditional lenders are increasingly challenged as they approach financial close and final investment decisions despite significant funding included in the IRA.

Meanwhile, IRA incentives have triggered a boom in private capital for energy transition projects that can employ a higher degree of equity than debt, such as solar and onshore wind. “Any project that can rely on proven technology, clear tax credit provisions, and smaller total capital spend per unit of energy has benefitted from a willingness among private capital firms to move ahead using equity-intensive financing structures,” said Peter Gardett, executive director for Research and Analysis with S&P Global Commodity Insights.

—Aaron Larson is POWER’s executive editor.